The brand new freelancer’s guide to getting paid on time

2020 has been a year of big change and that's putting it mildly...

The challenges of lockdown have been tough for freelancers, but some have used 2020's periods of isolation to get new projects off the ground and start businesses. Whether you've decided to seize the day, or were pushed by redundancy, going freelance is a liberating and terrifying step. You need all the information and help you can get, especially when it comes to making it work financially.

Cashflow doesn't have to be a concern. This is the brand new freelancer's guide to getting paid fast.

Keep flawless records (or get an automated tool to do it for you)

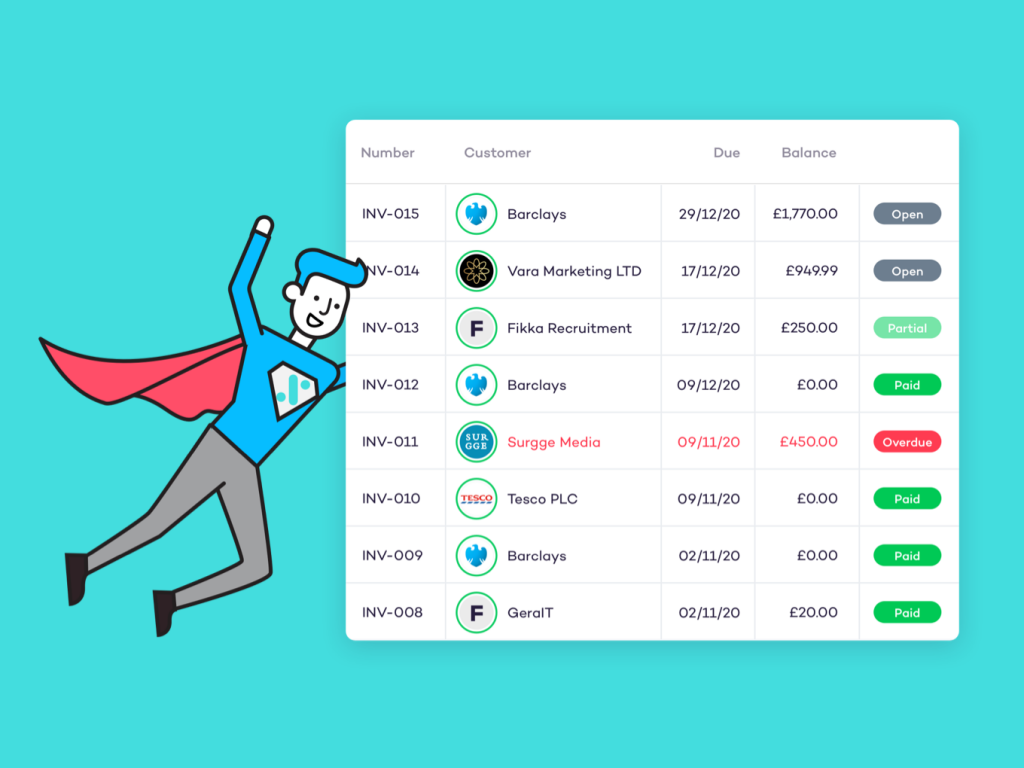

Recording everything is both a legal requirement and essential for your own peace of mind. If you don't know what's coming in and going out, you won't really know how your freelance business is doing financially.

An Excel spreadsheet can be a good place to start if you want to keep costs down, but automated tools are better. Accounting tools will track everything but can be a bit too 'all singing, all dancing' and expensive for new freelancers.

You can track invoices until they get paid FOR FREE with Solna. See what's due, what's late, and what's been paid at a glance. All in one easy, readable place.

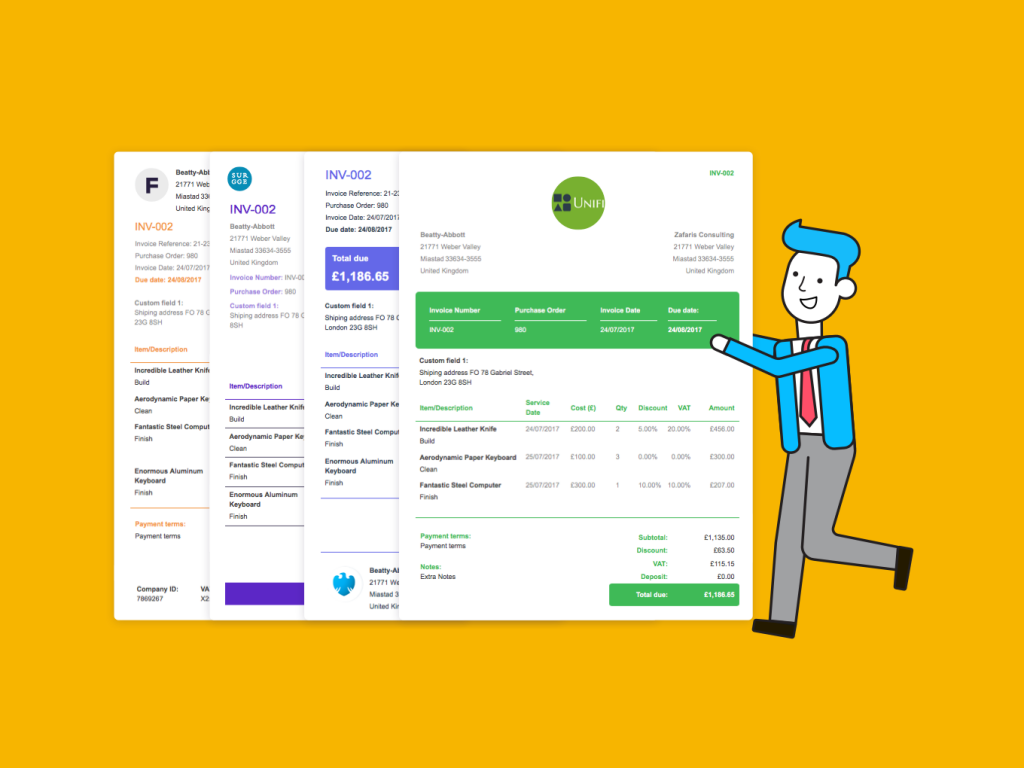

Get your invoice template right

Rather than getting a salary paid to you automatically, your freelance business now needs to invoice clients to get paid. Invoices seem like simple documents (how complex can they be, right?) but the way your invoice is written and structured is actually a key element of getting paid on time.

This is what your invoice should include:

- Your business name, address, and contact details (if you're a sole trader your own name is fine).

- Your client's business name, address, and contact details.

- An invoice reference number.

- A due date.

- An itemised list of what you're charging for.

- Your bank details (the most important part!)

You can include a few helpful extras too, like your business' logo (looks nice and professional) and a thank you note (always appreciated!).

You can get FREE stylish invoice templates with Solna. Look professional from day one and never forget to include your sort code. Solna invoice templates are modern, stylish, and automatically created.

Get educated on your late payment rights

Late invoice payments can be a shock for new freelancers. The stats make for fairly grim reading... 55% of freelancers have done work they haven't been paid for and 41% of businesses hiring freelancers regularly pay them late.

According to the Late Payment of Commercial Debts Act 1998, you can charge interest and debt recovery costs to a late paying client once the invoice is 30 days past the due date (or the period stated on the invoice if it's longer than 30 days). There's lots of guidance on the government website for how to do this.

The important thing to remember is you do have rights and you can do something about late payments. Sometimes just quoting the Late Payment Act and sounding very serious about it is enough to get your invoice paid!

Know how to chase a late invoice

Some of your clients will pay late and it's up to you to chase them. It can be a bit of an awkward email to write or phone call to make, with many freelancers fearing they'll damage the relationship if they ask for their money. 23% of freelancers say they've continued to do work for clients that owe them money.

Chasing a late invoice isn't rude. If your client is a small business and you're mainly dealing with an individual business owner, go straight to them. Whether it's an automated reminder or something you're typing yourself, keep it polite, brief, and direct.

Larger businesses usually have more of a process. Initially, talk to your main contact in the business and ask them if you can go ahead and talk directly to accounts. Their role will simply be to pass the invoice onto accounts so they're not personally responsible for getting it paid. You're better off talking directly to the people who make the payments. As always, be polite, brief, and direct!

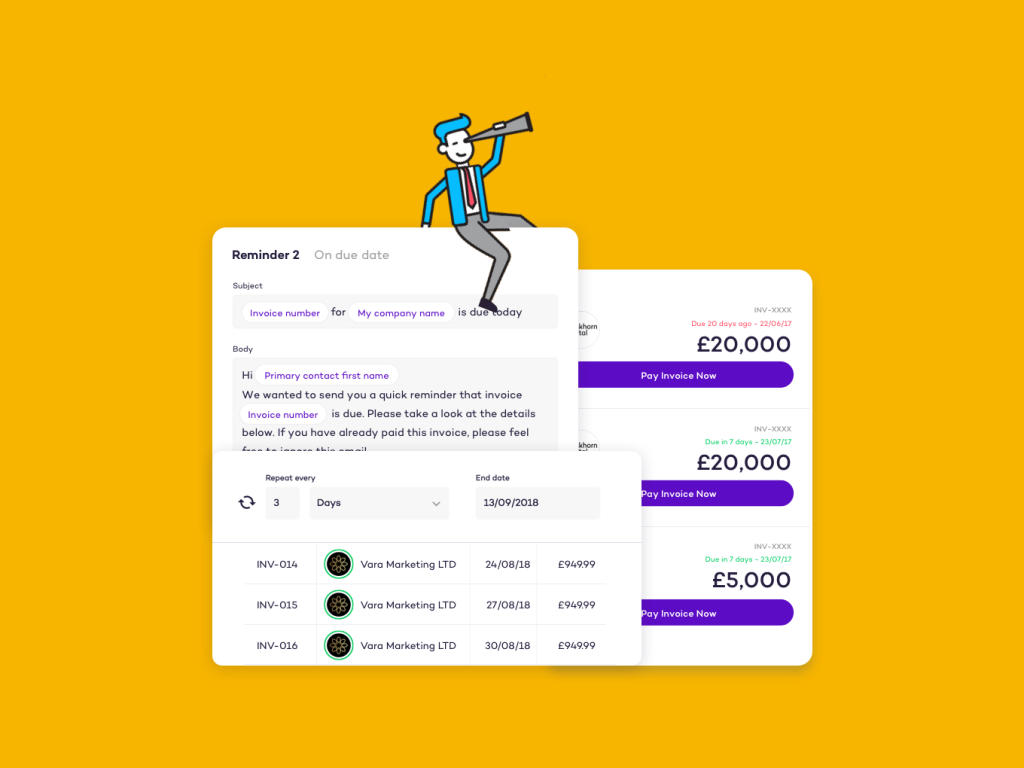

Automate your invoices for FREE

Solna invoicing includes automatic reminders, an easy pay-in-the-invoice button for your clients, and an intuitive dashboard to help you keep track of cash coming into your business. It's perfect for new freelancers who want to stay organised without spending any extra cash.

Plus, it's FREE. Sign up now.