These are freelancers’ 4 biggest financial stresses and how to sort them out for good

Running your own solo business might feel small time but the number of financial jobs to sort out and organise can be pretty daunting. Your previous full-time job was comparatively straightforward - do what you're contracted to do, get paid after tax, know exactly how much you're earning - but freelancing is completely different.

These 4 common financial stresses can be fixed. This is how to sort them out permanently and get a better handle on your freelance finances.

Not filling out your Self Assessment correctly and not knowing how much tax you owe

Tax season isn't fun for anyone but for freelancers - especially new freelancers - it can be really nervy. There's quite a lot of paperwork, you've never paid tax manually before, and it's easy to imagine that you're going to get it wrong and get a big old fine. Don't stress, it's actually simpler than you think.

How to sort it out:

If your tax situation is pretty straightforward you can file your Self Assessment through an online accounting tool. It's much quicker than logging into Government Gateway. They'll explain each field and what you need to fill in and import all the figures automatically. They'll also calculate what you owe throughout the year so there'll be no big cold sweat moments in January.

If things get a bit more complicated and your accounting tool is telling you some of your calculations aren't supported, it's time to get an accountant. They'll do the hard work for you. Go off recommendations from fellow freelancers and read the independent reviews before you choose.

Getting paid late and constantly chasing invoices

41% of businesses surveyed by The Credit Protection Association (CPA) admit to paying their freelancers late. That's two and a half weeks late on average, which really matters when you've got your own bills to pay.

How to sort it out:

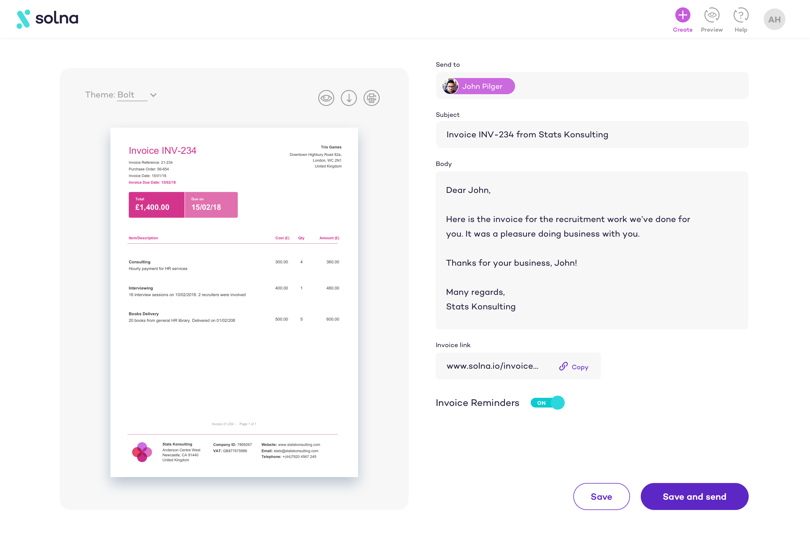

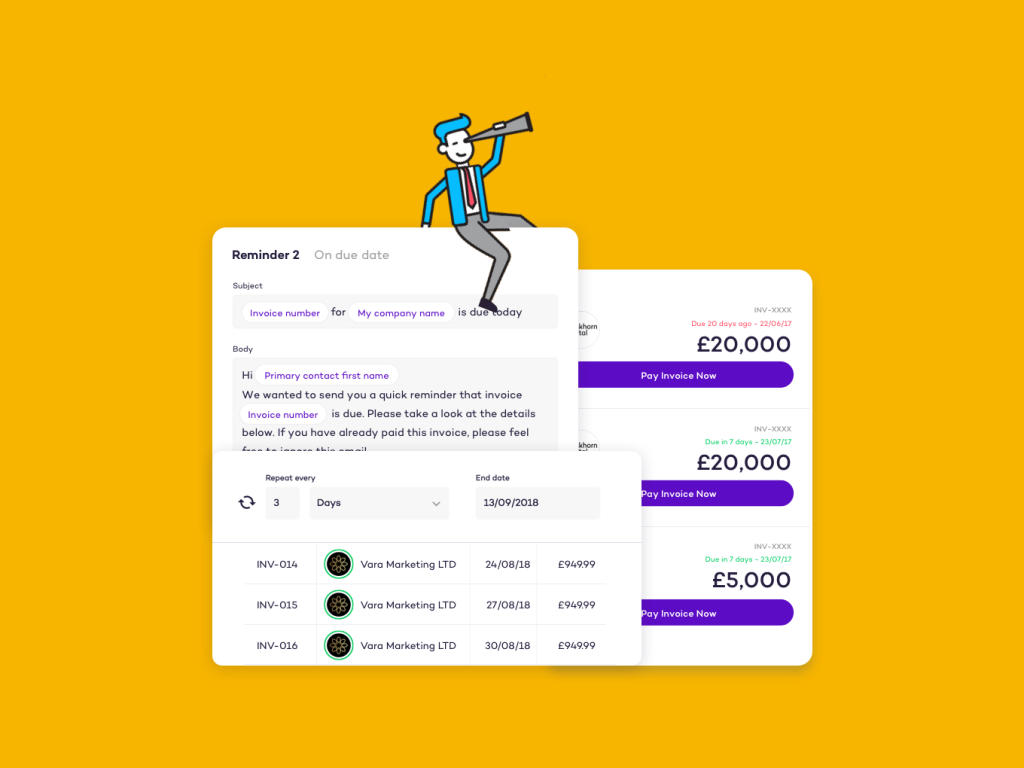

If invoices are routinely coming in late, it's time to automate. Solna helps you create invoices in seconds with stylish branded templates, send automatic reminders, and track every invoice until it's paid. If clients are dragging their feet you can give them a nudge automatically and get your money faster.

You could also adjust your payment terms and be up front with clients before work starts. 30 days is common but it's not compulsory. You can negotiate monthly retainers so you always know what's coming in and ask for a deposit for big jobs.

Feeling strapped and living 'invoice to invoice'

Does cash leave your bank account as soon as an invoice gets paid? Living invoice to invoice basically means living a bit too close to the edge and never letting your hard-earned cash build up. It's what happens when freelancers are struggling to save, overspending, or perhaps not charging enough.

How to sort it out:

If you're not charging enough it's important to value yourself and the time you put in fairly. As you gain experience, talk to your clients about your rate increasing. If they like you and your work they'll keep paying it. When you're charging for a project, add a bit of extra time on to cover last minute changes and unexpected delays so you're paid accurately. And most importantly, don't let potential clients negotiate your price down - your skills and experience can't be haggled!

If you're not saving enough put a plan in place. Over-save for your tax bill and then transfer what's left into an ISA. Save a percentage of every month's profits. Cut some costs if you're overspending. It adds up to greater security.

Not having a reliable income if things go wrong

2020 taught us that things can change very quickly. Freelancers get ill, need to take time off, have family issues to work through, deaths to deal with, and much more. But as an independent business you know all too well that if you don't work you don't get paid.

How to sort it out:

We blogged about this in the early days of the pandemic and collated lots of helpful advice for supporting your income during periods of uncertainty. Give it a read here.

Anxiety often builds up when you avoid a potential financial issue. You can alleviate a lot of that stress by maintaining consistent communication with your clients during challenging times. Be up front when you need some time, offer alternatives, and (if you can) give them a realistic idea of when you'll be back to normal.

Automate your invoice reminders for FREE

Solna makes getting paid a doddle. Automate your invoice reminders, track all your due dates on a super smart dashboard, and create smart, professional invoices from our range of templates. Start invoicing for free, FOREVER.