The ultimate guide to getting a mortgage if you’re self-employed

According to a survey by The Mortgage Lender, 73% of freelancers think they could be discriminated against because of their self-employment.

Freelancers are perceived to have less reliable sources of income than the full-time employed and be riskier to lend to. This can mean mortgage lenders are reluctant to approve them for a large loan.

Reluctant doesn't mean it's impossible though. With the right advice, freelancers can get a mortgage too. This is how.

Find a mortgage advisor that specialises in helping the self-employed

This one's an essential first step. You need professional, impartial advice from an experienced independent mortgage advisor who's helped freelancers before.

Self-employed mortgage advisors will know what lenders will ask for, what will make them reject, and - most importantly - what will make them accept. There might be things you need to do now to be ready to apply in the next year or two. For example, you might need to change your self-employment status from sole trader to limited company director.

There might be some things you were planning to do - like take a month or two off - which your mortgage advisor would advise against. It's much better to know now!

Everyone trying to get a mortgage needs independent advice, but freelancers trying to get a mortgage need specialist independent advice. Don't be tempted to go it alone - if you're declined it won't look good on your next application.

Learn how lenders will calculate your income

How much you earn affects how much you can borrow. Whether you're a sole trader, a contractor, or a company director, you might need to prepare one, two, or three years of accounts. Possibly more, depending on the lender. If you have a few years' history with consistent earnings, you should look pretty reliable.

Next, you need to find out what kind of income lenders will consider. It could be net earnings, dividends, your day rate, profits - or a combination.

Find out what documentation you need

45% of freelancers have found it difficult to provide the right documentation to mortgage lenders.

You obviously need proof of ID and address, as well as proof of deposit and income. One thing you might not be aware you need as a freelancer is a SA302. This shows tax calculations from your previous four years of Self Assessment tax returns.

You can use HMRC's online services to print your own, but your mortgage provider might not accept self-printed documents. Your mortgage advisor and accountant will be able to help you access your SA302 if you're not sure.

Look for long-term contracts and repeat business

Mortgage lenders will be unsure about you if your income mainly comes from short-term contracts. From their perspective, these contracts could run out at any time and leave you income-less.

If you're planning to apply for a mortgage soon, now's the time to engage in long-term contracts with clients. You'll be a much more reliable lending prospect.

Whatever advice you decide to take, put it into practice with your accountant

If you've managed to do your accounts well without an accountant so far, those days are unfortunately over. It's essential to have an accountant prepare your accounts and sign them off if you're applying for a mortgage.

Your accountant will also be able to help you save appropriately for your deposit, change your self-employment status if necessary, and provide important documents. They're there to help you, make sure you use them.

Getting a mortgage if you're self-employed: The key takeaways

Freelancers have to jump through slightly different hoops when it comes to getting a mortgage, but with the right preparation and advice it's more than possible.

- Engage an accountant - you'll need one!

- Seek out independent mortgage advice from an advisor who specialises in working with the self-employed.

- Find out which documents you'll need.

- Work on long-term, reliable contracts.

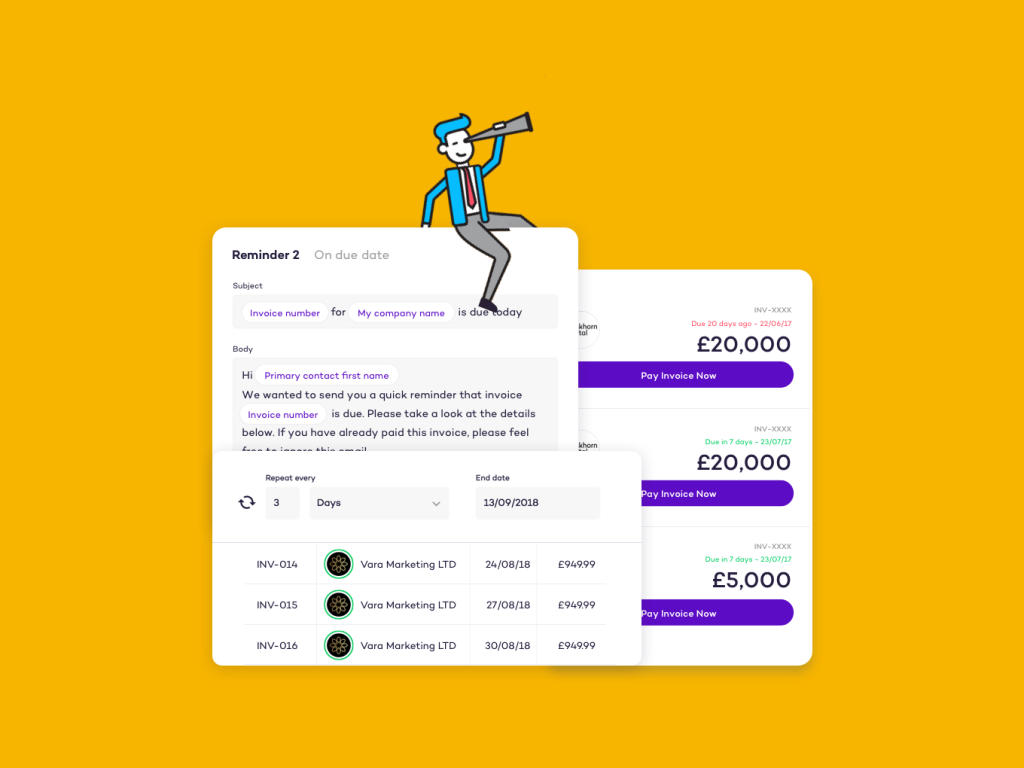

Solna will help you get paid on time

If you're applying for a mortgage, the last thing you want to be doing is chasing payments you should have received *checks calendar* last month.

With Solna, you can automatically chase invoices and accept online payments - which speed up payments by 3x on average. Plus, it's free FOREVER.