This is why your clients could be paying your invoices late

IPSE - the UK's association for freelancers and the self-employed - has always been concerned by late and non-payment of invoices. It's one of the biggest issues facing its members. IPSE's 2022 survey of their freelance members shows how big an issue it is for the self-employed community.

- 35% of freelancers haven’t been paid on time by a client in the last 12 months.

- Freelancers are owed £5,230 on average. That's slightly up from £5,140 in 2020.

- This has left 20% of freelancers surveyed struggling to pay for basic living costs.

Why are invoices consistently paid late by some clients? Why do many freelancers have to keep chasing them?

These are some of the reasons why late payments are dominating so many freelancers' time, and why there might be a better way.

Your clients have disjointed and disorganised accounts processes

Dodgy accounts processes can plague your experience with clients, whether they're one-man-bands, an agency, or a large international firm. This can mean unreliable responses, unclear payment dates, and very little recourse when the due date slips by.

It could be that the main accounts person is off sick or is never available when you need them. There might be just one person responsible for everything and they're not very organised or have too much on their plate. It could even be that there isn't an accounts department or a clear process at all.

For 23% of freelancers surveyed by IPSE, this means waiting between 1 week and 1 month for their late invoice payments, while 35% are waiting between 1 and 3 months.

Your clients have a strict payment schedule and your invoice was late

This isn't so much about being paid late, but receiving your payment later than planned.

Some clients have very efficient accounts processes with fixed payment run dates. If you fail to send your invoice in time for the next payment run, you could end up being paid late. Thankfully, this is a mistake you usually only make once and is easily fixed in the next invoicing period.

Your clients don't have the funds (or don't have the funds yet)

A total lack of funds is often the worst case scenario in many freelancers' minds because it can mean an invoice payment won't just be late, it's could be non-existent.

Clients short on funds (which, ironically, could be because their own clients aren't paying on time) might delay paying their invoices for as long as possible or avoid payment altogether. This is frustrating for you but might be the only way they think they can keep operating.

Your clients are trying to keep cash in their accounts for as long as possible

Rather than not having the funds to pay, your clients might be holding onto money to improve cash flow. Your client might need cash in the bank to pay for stock, staffing costs, equipment, or many other things.

Keeping cash in the business can also be a strategic decision to gain interest on bank balances, prepare healthy-looking year-end accounts, pay off debt, or improve the chances of being approved for a new line of credit. Unfortunately, this might be more pressing than paying your invoice.

What you can do to speed things up

Know exactly when a payment becomes late and what you can (legally) do about it

IPSE has some helpful advice for freelancers dealing with late payments. In short, the invoice is late if it hasn't been paid by the due date, whether that's 30 days, 60 days, or more. But legally the payment is late 30 days after the invoice has been received by the client or the goods and services have been delivered (if that's later than the date of the invoice).

According to The Late Payment of Commercial Debts (Interest) Act 1998, you can claim interest and debt recovery costs on top of the invoice amount. IPSE have a helpful guide to calculating this too.

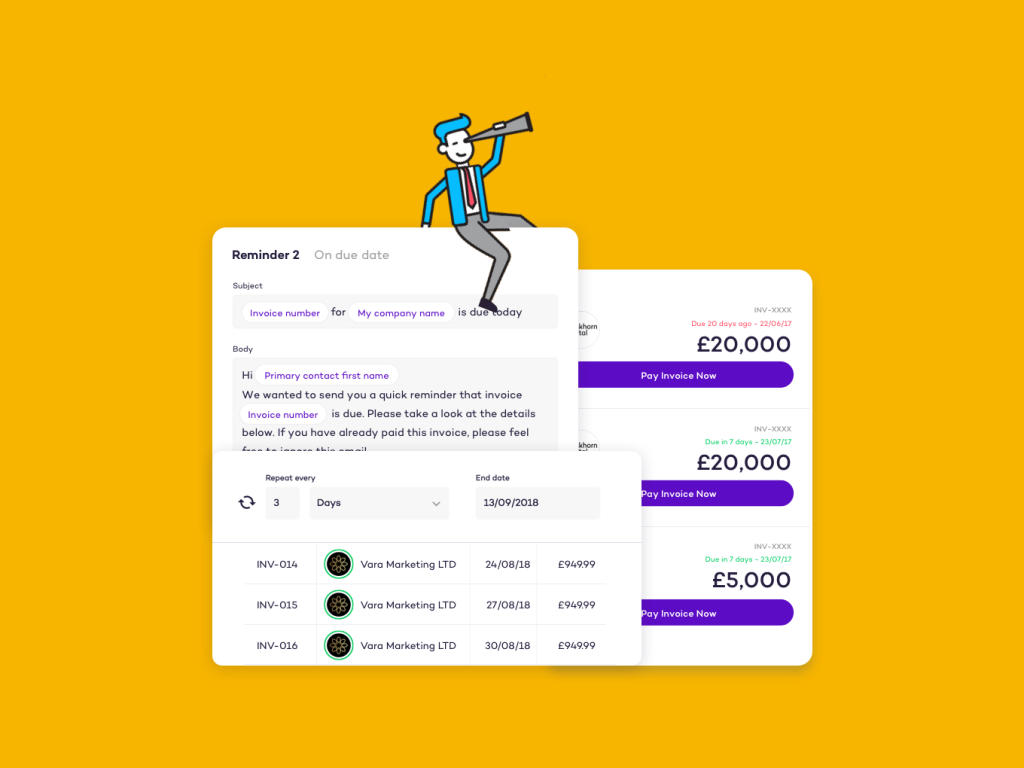

Automate chasing late invoices

The process of reminding clients and trying to maintain good relationships with them at the same time is exhausting for many freelancers. An automatic invoice reminder takes a lot less time, removes a lot of the back-and-forth, and can get you paid faster.

With Solna, you can automatically chase invoices and accept online payments - which speed up payments by 3x on average.

Set boundaries

When late payments become a real problem, it might be time to get serious. For example, if a client already has two invoices outstanding and is asking for more work, it's totally up to you as a freelancer to decide to say no. Some clients might be so persistently unreliable that it's not worth the stress of working with them anymore.

Setting boundaries is tough, especially if you're worried about damaging the relationship or harming your chances of getting paid at all. But if the relationship is already suffering, and you're worried about invoices, it could be worth putting your foot down in a way you're comfortable with.

Get invoices paid - especially the late ones - with automatic invoice reminders