Freelancing and sick pay. What are your rights and how can you protect yourself?

Freelancers aren't entitled to sick pay from an employer - because they don't have one! This can make a period of illness or injury difficult to manage and anxiety-inducing.

Instead of hoping you don't get ill, this is how to create a safety net for your freelance business.

Does the law protect freelancers experiencing sickness?

As of April 2023, Statutory Sick Pay (SSP) is £109.40 per week and paid by an employer for up to 28 weeks.

You can't apply for SSP if you're self-employed and a sole trader because you don't have an employer. However, you can claim if you're a limited company director and meet the qualifying conditions. Solo freelancers could claim Employment Support Allowance (ESA), which is £84.80 a week. This is paid every two weeks until you can continue working.

With the cost of living as high as it is, this basic level of help is unreliable and clearly not enough for most freelancers. Here are some other resources freelancers can access to maintain their income if they experience a period of sickness.

Income protection insurance

With income protection insurance, freelancers will be able to cover some of their lost earnings if they're sick. Cover can be short-term and run for a limited period, or long-term and cover a freelancer for as long as they need.

Generally, freelancers experiencing sickness or injury will receive tax-free payments of 50-65% of their usual monthly income. Depending on the policy, there can be a wait before receiving your first payment.

Like any insurance policy, you'll pay a monthly premium. This can vary depending on your age, existing health conditions, average monthly income, and how long you want your policy to last. Freelancers earning a high monthly salary and looking for long-term cover are likely to have a more expensive policy.

You can use your insurance to pay for essential living costs, like rent or mortgage payments, bills and utilities, and debt repayments. You can't use it to pay for business expenses.

You should compare different income protection insurance providers to find the best cover available.

Critical illness cover

Critical illness cover is a type of life insurance policy. It isn't specifically designed for freelancers, but it can help them to cover their expenses if they experience a serious illness or injury which isn't life-threatening but serious enough to stop them working. This could include heart attack, stroke, non-terminal cancers, and physical disability.

Freelancers claiming critical illness cover receive a lump sum - which can be tax free - instead of monthly payments. Just like income protection, critical illness cover costs can vary depending on the type of cover required.

Health insurance

A health insurance policy won't help cover your income, but it can help you access quicker treatment, which could make it possible to return to work faster.

As well as the NHS, health insurance can give freelancers access to private healthcare, shorter waiting lists, and specialist consultants. Access to private treatment, with its flexible appointment times and locations, can be helpful if you need to fit healthcare around work. Some private healthcare plans include cover for your family too.

A savings plan

Depending on the interest available, and how easy it is for you to save each month, a solid savings plan could provide a lot of peace of mind. If you do experience a period of sickness or injury, and have to reduce your working hours, savings can cover essential expenses and significantly reduce stress.

There are different schools of thought in terms of how much you should save, but a good benchmark to aim for could be 3-6 months' of income. Look for high interest, accessible savings accounts, and set up a regular standing order to build up your rainy day fund.

Plan around existing conditions and illnesses

For freelancers with long-term and chronic conditions, periods of ill health are unfortunately a given. Understanding your triggers, and what exacerbates your conditions, can minimise the impact of this. Exercise, diet changes, self-care, adjustments to your working environment, and taking regular breaks can help you stay on top of recurring health problems.

When a period of ill health is unavoidable, be ready to reduce your workload and have open, clear conversations with your clients about what you can and can't deliver.

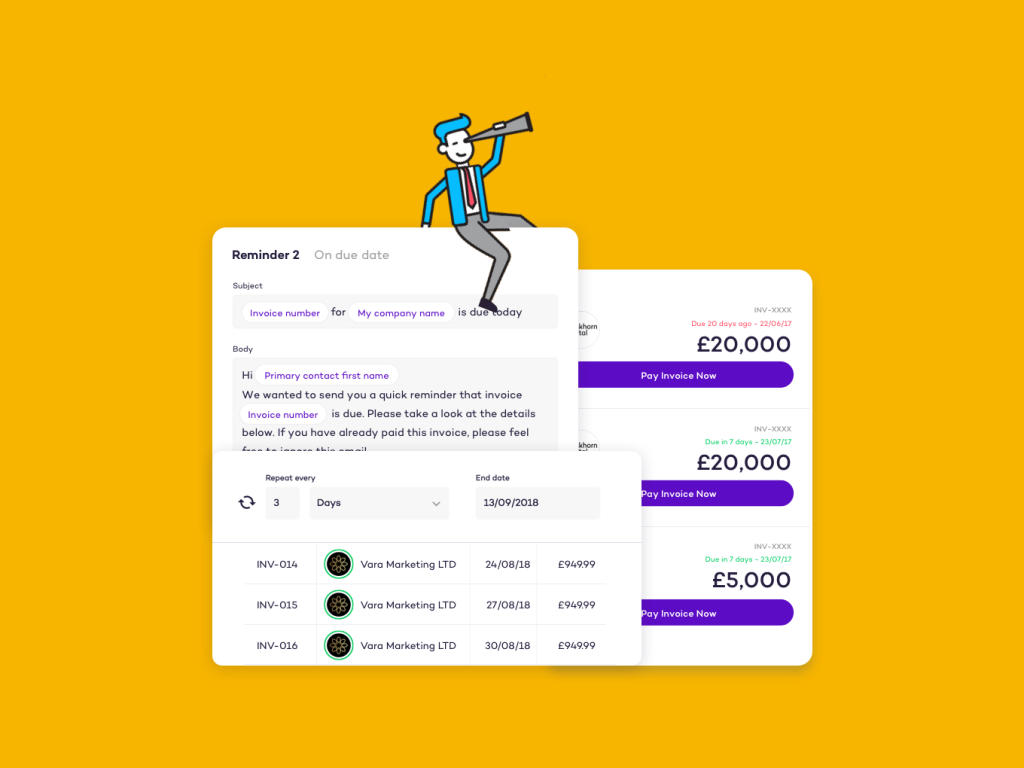

Get your freelance invoices paid - 3x faster on average

With Solna, you won't need to worry about your invoices getting paid. Freelancers can create and send custom invoices in seconds, automate their cash flow, and get paid 3x faster on average. Get Solna for free.